White-label crypto cards are financial products issued by one company (the issuer) but branded and used by another (the acquirer), typically a crypto exchange development company. They come in various types, including debit cards, credit cards, and prepaid cards. These cards allow businesses to offer banking products under their branding without having to develop the underlying infrastructure. White-label solutions are gaining prominence in the financial sector, enabling companies to issue cards under their branding without the need to build the technology themselves.

White-label solutions are gaining prominence in the financial sector, enabling companies to offer these types of cards under their branding without the need to develop the underlying infrastructure. White-label crypto cards come in various types to suit different financial needs and preferences.

The common types of white-label cards include:

- Debit cards: These cards offer users access to funds in their bank accounts and are often used for everyday transactions and ATM withdrawals.

- Credit cards: Just like credit cards, one borrows money up to a given amount for buying and they repay later.

- Prepaid cards: These cards come with a preloaded cash amount which is perfect for saving and budgetary issues.

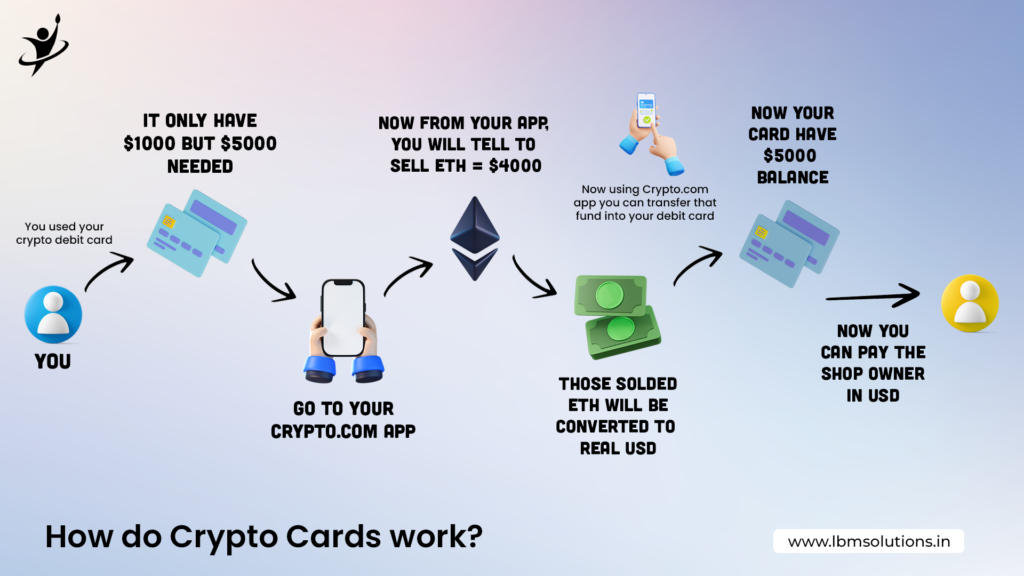

How do Crypto Cards work?

White-label crypto cards, on the other hand, can be used in both physical and e-commerce shops. They blend the ease of use of traditional cards with the advantages of cryptocurrencies like speedy, safe payments that cross borders. The acceptance of white-label crypto cards depends on the payment network, the agreement signed between the issuing financial institution and payment processors, and the local regulations. These innovative cards offer a bridge between the crypto and traditional financial worlds, providing numerous benefits for crypto exchange development company.

The process of using a white-label crypto card typically involves the following steps:

- Loading funds: Crypto cards are preloaded with digital assets, allowing users to spend their crypto funds at various points of sale.

- Converting crypto to fiat currency: When users make a purchase, the card converts the crypto funds into fiat currency at the point of payment.

- Transaction: The payment details are sent through the card network to the customer’s bank for approval.

Bitcoin exchange software provides the technology platform for buying, selling, and trading cryptocurrencies. White-label crypto cards can be integrated with this software, allowing users to:

- Convert crypto to fiat currency directly on their cards: No need for separate exchanges or conversions, making transactions more convenient.

- Fund their cards with various cryptocurrencies: Offer flexibility and cater to diverse user preferences.

- Manage their cards through the exchange software: A single platform for managing both crypto assets and card transactions.

Benefits of Crypto Cards with Crypto Exchange Software

By offering white-label crypto cards, crypto exchange software development companies can unlock a wealth of benefits. Crypto cards integrated with crypto exchange software offer several benefits such as:

- Customization and Branding: White-label crypto payment gateways allow businesses to customize the interface of their payment gateway, including logos, brand name, and domain name, ensuring a consistent user experience and reflecting each brand’s unique identity.

- Security: These cards often employ security features such as 2-factor authentication, whitelist, PIN code, and more to protect users’ funds.

- Scalability: White-label solutions can help businesses scale their payment processing capabilities, accommodating a growing user base and increasing transaction volume.

- Revenue Generation: Businesses can earn revenue through issuance fees, transaction fees, and partnerships with card providers.

- Effortless crypto transactions: Crypto cards enable users to spend their crypto holdings directly without the need to convert them into fiat currency, streamlining the payment process.

- Generous cashback programs and perks: Many crypto cards offer rewards and benefits, such as cashback on purchases, travel rewards, and other incentives, making them attractive to users.

- New revenue streams for exchange businesses: Crypto exchanges can charge issuance or purchase fees, and transaction fees, and earn from partnerships with card providers, opening up new revenue streams.

- Contribution to an increased crypto user base: By simplifying crypto transactions, crypto cards issued by crypto exchange software providers can contribute to an increased crypto user base, benefiting the entire industry.

These benefits make crypto cards an attractive offering for crypto exchange businesses, driving user adoption and engagement

How to Apply for a Crypto Card? Examples of Crypto Cards?

To apply for a crypto card, you can follow the specific application process outlined by the card provider. Here are the general steps to apply for a crypto card, along with examples of crypto cards:

- Sign Up and KYC: The individual should download the crypto app, KYC, and verify their identity.

- Select Card Tier and Lock Up Tokens: Choose your preferred card tier and lock up the required cryptocurrency tokens, if applicable.

- FD Option: Invest a fixed amount of fiat currency in an FD for a specific duration. The interest earned on the FD can be used to purchase cryptocurrency or offset card fees. This option offers a stable return on your investment while fulfilling the card tier requirement.

- RD Option: Set up a recurring deposit of fiat currency into your crypto wallet. This allows you to gradually accumulate cryptocurrency over time and meet the card tier requirement without needing a large initial investment.

- Request Card Shipment: After the card is ready to ship, you may be prompted to update the app and complete the necessary steps. You can also request a physical card to be delivered, with potential issuance fees. When applying for a physical card, you may be required to pay an extra card allotment fee.

- Card Activation: Once your minimum balance requirement is met, activate your virtual card within the app. This allows you to start spending your cryptocurrencies instantly.

Examples of Crypto Cards

Crypto cards are revolutionizing the way people interact with their digital assets. By offering users a convenient and secure way to spend their crypto anywhere, a crypto exchange development company can tap into a powerful growth opportunity.

- Crypto.com Visa Card: Users can apply for this card by signing up for a Crypto.com App account, completing the KYC verification, and purchasing CRO tokens.

- Gemini Crypto Credit Card and Coinbase Visa Card: These are examples of crypto-linked credit cards that are jointly owned by a bank and a cryptocurrency exchange. While the application procedures for these cards are almost the same as those for normal credit cards, one must submit an application form and go through a credit inquiry.

- Other Crypto Cards: There are various other crypto cards available, such as the Coinbase Debit Card and the BlockFi Rewards Visa Signature Credit Card, each with its application process and benefits.

The specific requirements and application processes may vary depending on the provider and the type of crypto card. It’s important to review the terms and conditions, fees, and benefits of each card before applying.

In a Nutshell,

White-label crypto cards offer businesses the opportunity to offer innovative financial products to their customers without the need to develop the underlying infrastructure, streamlining the payment process and enhancing user experience. By using the benefits of white-label crypto cards, businesses can stay competitive in the rapidly evolving world of digital payments and cryptocurrencies. Moreover, businesses can provide their customers an opportunity to buy crypto using credit cards, simplifying investment in digital assets. White-label crypto cards represent a powerful opportunity for businesses and crypto exchange development company to thrive in the evolving digital payments landscape. These innovative solutions can help to improve customer experience and stimulate revenue growth by bringing competitive advantages to the expanding crypto industry.