Centralized cryptocurrency exchanges are like digital marketplaces where people trade cryptocurrencies. They’re the go-to places for buying and selling digital currencies. These exchanges play a big role for investors in managing their cryptocurrency investments.

The term “centralized” might confuse some because cryptocurrencies are supposed to be “decentralized.” But in this context, “centralized” means these exchanges have a central authority managing transactions. Understanding this helps grasp why these exchanges are vital for the overall success of the cryptocurrency world.

Getting into the realm of cryptocurrencies is as confusing and challenging as it can get. However, having an experienced crypto exchange development company at your disposal can be a sigh of relief.

Knowing the context of the term, you should get a better understanding of what is a CEX.

Understanding Centralised Exchange Development

In the world of best-centralized crypto exchanges, the term “centralized” points to the involvement of a middleman facilitating transactions between buyers and sellers. This is akin to relying on a bank to handle and safeguard your money.

The primary reason for this reliance on intermediaries like banks or top centralized exchanges is the assurance of security and oversight they provide. Banks, for instance, offer layers of protection and monitoring that an individual might struggle to achieve independently. Similarly, the best-centralised crypto exchanges operate on this premise. Users trust these platforms to securely execute transactions and match them with the best crypto trading platforms within the exchange network.

Cryptocurrencies, usually stored in digital wallets, pose risks like losing access to funds due to forgetting access keys. Unlike an individual wallet, an exchange minimizes this risk by actively securing users’ holdings preventing potential losses.

Distinguishing Features of Centralised Exchanges

Centralized exchange development refers to creating and maintaining the best crypto trading platforms. These exchanges operate under the guidance of a central authority or organization, facilitating transactions between users.

Key Aspects of Centralised Crypto Exchange Development

Centralized exchange development is securely and successfully run by multiple features. Have a look and get a better view of the concept.

Secure User Access: The first layer of defense against unauthorized access and cyber threats lies in robust login and signup processes. The top centralized exchanges employ stringent authentication methods like two-factor authentication (2FA) and email verification to safeguard user accounts.

Copy Trading: A feature catering to novice traders, copy trading allows them to emulate the trading strategies of seasoned experts. This functionality automatically replicates the trades of successful traders, potentially enhancing the profitability of investments for users.

Tailored DDoS Protection: Custom-built protection systems shield exchanges against DDoS attacks on the best crypto exchange platforms, swiftly identifying and mitigating these threats. This defense mechanism ensures uninterrupted user access and functionality even during attack attempts.

ICO Facilitation: Centralised exchanges often support Initial Coin Offerings (ICOs), offering a platform for new blockchain projects to list tokens and gather funds. This offering simplifies the token sale process and attracts projects seeking reputable launchpads.

Trustworthy Escrow System: Integral for peer-to-peer (P2P) trading, an escrow system safeguards assets until predefined conditions are met. This feature ensures a secure and reliable exchange experience for users.

Cold-Wallet Integration: Enhancing security measures, cold-wallet integration stores a significant portion of user funds offline, away from online vulnerabilities. This protective measure shields user assets in case of security breaches or threats.

Keeping in mind the features of centralized exchange development systems, you can gather a better understanding of the concept.

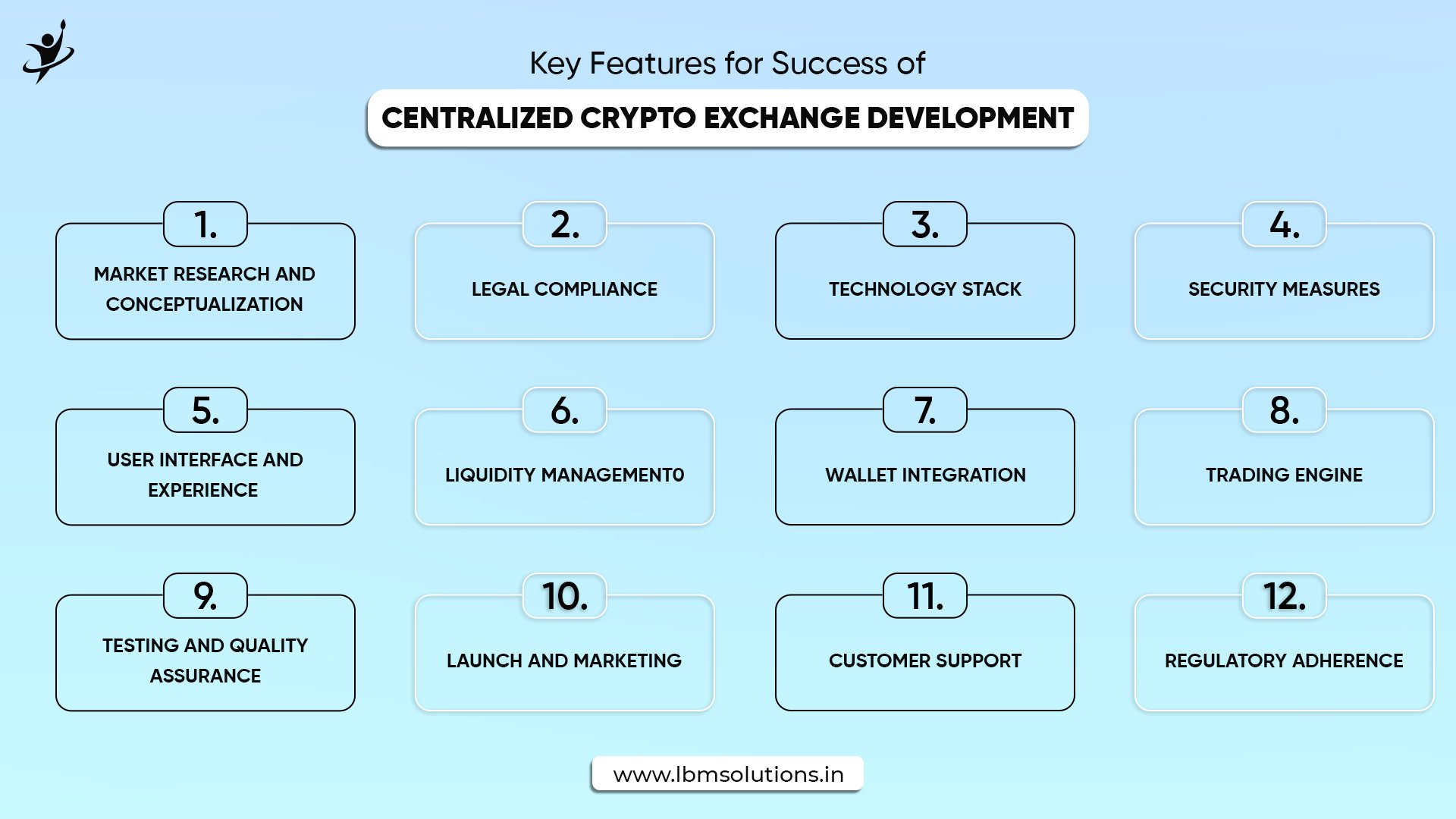

Building a Successful Centralised Exchange: Key Features for Success

Building a centralized exchange demands careful planning and execution. Here’s a simplified walkthrough:

Market Research and Conceptualization: Begin by surveying the competitive landscape and spotting a unique aspect or niche for your exchange. Decide on the variety of assets you intend to support.

Legal Compliance: Talk to legal experts to ensure compliance with local and international regulations. Obtaining licenses and adhering to regulations are crucial for running a centralized exchange.

Technology Stack: Select an appropriate technology stack encompassing programming language, database system, and blockchain integration for your exchange.

Security Measures: Prioritise robust security protocols incorporating encryption, DDoS protection, and regular security audits. Ensuring the safety of users’ funds is pivotal for building trust.

User Interface and Experience: Craft an intuitive and user-friendly interface. Design a responsive website or app offering essential features like trading pairs, order books, charts, and account management.

Liquidity Management: Forge partnerships with liquidity providers to maintain a seamless trading experience. Adequate liquidity is fundamental for attracting traders to your platform.

Wallet Integration: Incorporate secure wallets, enabling users to store their assets. Implementing cold storage solutions enhances security measures.

Trading Engine: Develop a robust trading engine capable of handling high-frequency trading and providing real-time market data updates.

Testing and Quality Assurance: Thoroughly test your exchange for vulnerabilities, glitches, and performance issues. Conduct a beta test with a small user group to gather feedback and refine the platform.

Launch and Marketing: Once satisfied with testing, officially launch your centralized exchange. Devise a marketing strategy to entice users and bolster liquidity.

Customer Support: Offer efficient customer support channels to address user inquiries and concerns promptly.

Regulatory Adherence: Continuously monitor and adapt to evolving regulatory standards to ensure ongoing compliance and legality of your exchange. Regular audits and updates are essential.

Once you are familiar with what is CEX, you can get in with the process of building a centralized exchange is a multifaceted endeavor, encompassing technical, security, legal, and user-centric aspects. An in-depth approach, compliance with regulations, and a focus on user experience are key elements to a successful launch and sustained operation.

Top Centralised Exchange Platforms to Watch in 2024

The prominence of top centralized exchanges can fluctuate over time, with new platforms frequently surfacing. Here’s a roundup of ten established and best-centralized crypto exchanges, considering their historical significance:

Binance: Renowned as one of the largest and most favored global exchanges, Binance offers a wide spectrum of cryptocurrencies for trading. It boasts advanced trading tools and hosts its native token, BNB.

Coinbase: Highly favored by beginners for its user-friendly interface, Coinbase provides a comprehensive list of supported cryptocurrencies. Its adherence to regulatory standards is notable.

Kraken: With a strong presence in Europe, Kraken is esteemed for its security measures and offers an array of tradable cryptocurrencies.

Huobi: A global platform, Huobi delivers a diverse range of cryptocurrencies and stands out for its user-friendly interface and trading pair options.

OKEx: Catering to a global audience, OKEx offers a myriad of digital assets featuring spot trading, futures, and more.

Bitfinex: Noted for its liquidity and advanced trading features, Bitfinex provides diverse trading pairs, solidifying its position in the crypto landscape.

Gemini: The Winklevoss twins established Gemini as a regulated U.S.-based exchange emphasizing security and regulatory compliance.

KuCoin: Recognized globally, KuCoin presents an extensive array of cryptocurrencies and has gained traction due to its user-friendly interface.

Bitstamp: A longstanding player in the crypto sphere, Bitstamp boasts a solid reputation, especially in the European market.

Bittrex: Renowned for stringent security measures, Bittrex offers various cryptocurrency trading pairs and has been operational for years.

It’s essential to acknowledge that the cryptocurrency market is dynamic, and the status of exchanges can shift. Before selecting an exchange, reviewing recent user feedback, available security features, and the best crypto trading platforms that align with your preferences is advisable. Regularly checking for updated information ensures making informed decisions in this ever-evolving landscape.

Getting in touch with an expert crypto exchange development agency can give you deep insights on how to keep up with the crypto trends.

Conclusion

Constructing a centralized cryptocurrency exchange involves a comprehensive process encompassing vital elements crucial to its success. Each facet significantly influences the exchange’s durability and triumph, from security measures to user interaction, regulatory adherence, and adaptability.

You should know that security serves as the bedrock of user confidence here. Employing top-notch encryption, robust authentication methods, and consistent security checks are pretty important. Prioritizing the protection of users’ digital assets builds trust and cultivates a strong market reputation.

At the same time, user experience, driven by an intuitive interface, is essential for attracting and retaining traders. A well-crafted platform, seamless onboarding, and responsive customer support designed by an experienced crypto exchange development firm like LBM Solutions can simply enhance user satisfaction and bolster the exchange’s competitiveness.

The professional crypto exchange development company also focuses on scalability to accommodate increasing user activity. It ensures optimal performance, even during high market demand. Regular updates, upkeep, and risk management strategies support the platform’s resilience and reliability.

Developing a centralized cryptocurrency exchange with the professional assistance of a crypto exchange development company is a dynamic process requiring a holistic approach. By addressing these vital aspects comprehensively, developers can craft a secure, user-centric, and regulation-compliant exchange that caters to traders’ needs today and lays the groundwork for sustained success in the fast-paced digital asset landscape.