In an era accustomed to lightning-fast 5G internet and near-instantaneous food delivery within 15 minutes, enduring a whole day for a financial transaction feels exasperating.

The traditional banking industry, entrenched for centuries, struggles to align with the expectations of today’s technologically inclined clientele. Prolonged transaction periods, security vulnerabilities, and rigid operational hours represent a few predicaments confronting established financial institutions.

Enter the world of fintech innovation: neobanks emerged as a solution to these challenges.

However, before delving into a comparison between the best neobanks and traditional finance, it’s essential to grasp what is neobanking all about. Exploring this domain further could lead to collaborations with a cryptocurrency wallet development company to revolutionize financial transactions.

What is NeoBanking?

Neobanks represent digital-exclusive banking platforms functioning solely in the online sphere, devoid of physical branches. Unlike the potentially time-consuming transactions in traditional banks, the best NeoBanks ensure a streamlined digital experience by enhancing traditional banking with an immersive online layer. Their tech-driven approach enables effortless self-account creation and utilization of services, promising hassle-free operations for customers.

By integrating a label neo-banking platform into their service offerings, traditional banks are swiftly modernizing their operations and meeting the evolving demands of tech-savvy customers.

What are the Diverse Categories of Best Neobanks?

To understand the idea of neo-banks a bit better, let us explore the different types of best neo-banks that you can relate to.

Front-end Neobank

A front-end-focused neobank operates without its banking license, partnering with traditional financial institutions to deliver services. This model relies on collaboration, leveraging the established bank’s infrastructure and balance sheets for operational purposes. Essentially, it functions as an interface to customers, providing innovative services while relying on the backing of traditional banks behind the scenes.

Digital Banking Units

Standalone digital banks function as distinct entities in the established banking industry. To operate independently, these banks require a virtual banking license. They can acquire a full banking license once they accumulate sufficient capital to secure their investors’ deposits. This model offers autonomy within an established banking framework, enabling the provision of innovative services with the assurance of a trusted financial institution’s support.

Full-stack Digital Banks (Licensed)

Full-stack digital banks possess the necessary regulatory approvals and offer extensive financial services. These banks issue deposits, provide loans and maintain independent brand identities and balance sheets. Operating without the constraints of physical branches, they capitalize on the digital landscape, streamlining operations and delivering services efficiently in a digital-first environment.

The concept of fully licensed full-stack digital banks hasn’t been formalized yet. Nonetheless, regulatory bodies have proposed changes aimed at leveling the financial playing field, traditionally dominated by physical banks. These proposals intend to create a more inclusive ecosystem that accommodates and regulates the operations of the digital banking industry, fostering innovation while ensuring adherence to regulatory standards.

How are Banks Incorporating Crypto-Friendly Solutions?

Neo-banks, recognizing the expansion in demand for cryptocurrency-related services, are swiftly integrating these offerings into their platforms. Projections indicate that within a few years, more than half of the top 10 neo-banks will cater to customers with crypto-friendly Neobanking. This inclination arises from the discerned movement of funds from customer accounts to cryptocurrency exchanges, a movement neo-banks strive to retain within their platforms.

The surge in popularity of crypto services prompts neo-banks and challenger banks to incorporate such offerings, attracting clients keen on buying and selling cryptocurrencies with the assistance of a Cryptocurrency wallet development company.

In contemplating the inclusion of digital assets, the advantages become apparent. Neo-banks and challenger banks observe heightened engagement, new revenue streams, and increased user influx by integrating crypto banking. Crypto users exhibit notably higher engagement, frequently accessing neo-banking platforms. Incorporating crypto-friendly neobanking not only generates additional revenue but also encourages cross-selling opportunities for non-crypto products, enhancing customer interaction.

This strategic inclusion of crypto banking serves as a magnet for new users, expanding the neo-banks’ clientele and solidifying their stance in the dynamic financial landscape. Additionally, it showcases the adaptability and innovation inherent in these institutions, reflecting their commitment to meeting evolving customer preferences.

A cryptocurrency wallet development company can easily understand the significance of such integrations in reshaping the financial services industry.

Moreover, the popularity of offering crypto banking is on a rapid ascent. As neo-banks and challenger banks embrace these services, clients promptly embrace the opportunity to buy and sell cryptocurrencies with the assistance of a cryptocurrency wallet development company.

The advantages are clear for those contemplating the inclusion of digital assets in their offerings. Neo-banks and challenger banks witness notable outcomes upon incorporating crypto neo-banking solutions into their platforms: heightened engagement, new revenue avenues, and an influx of new users. Crypto users, in particular, exhibit higher engagement, logging into neo-banking platforms twice as frequently as non-crypto users. Introducing crypto-friendly neobanking into product lines opens avenues for additional revenue through price premiums and facilitates cross-selling opportunities for non-crypto products as customers engage more extensively with the platform.

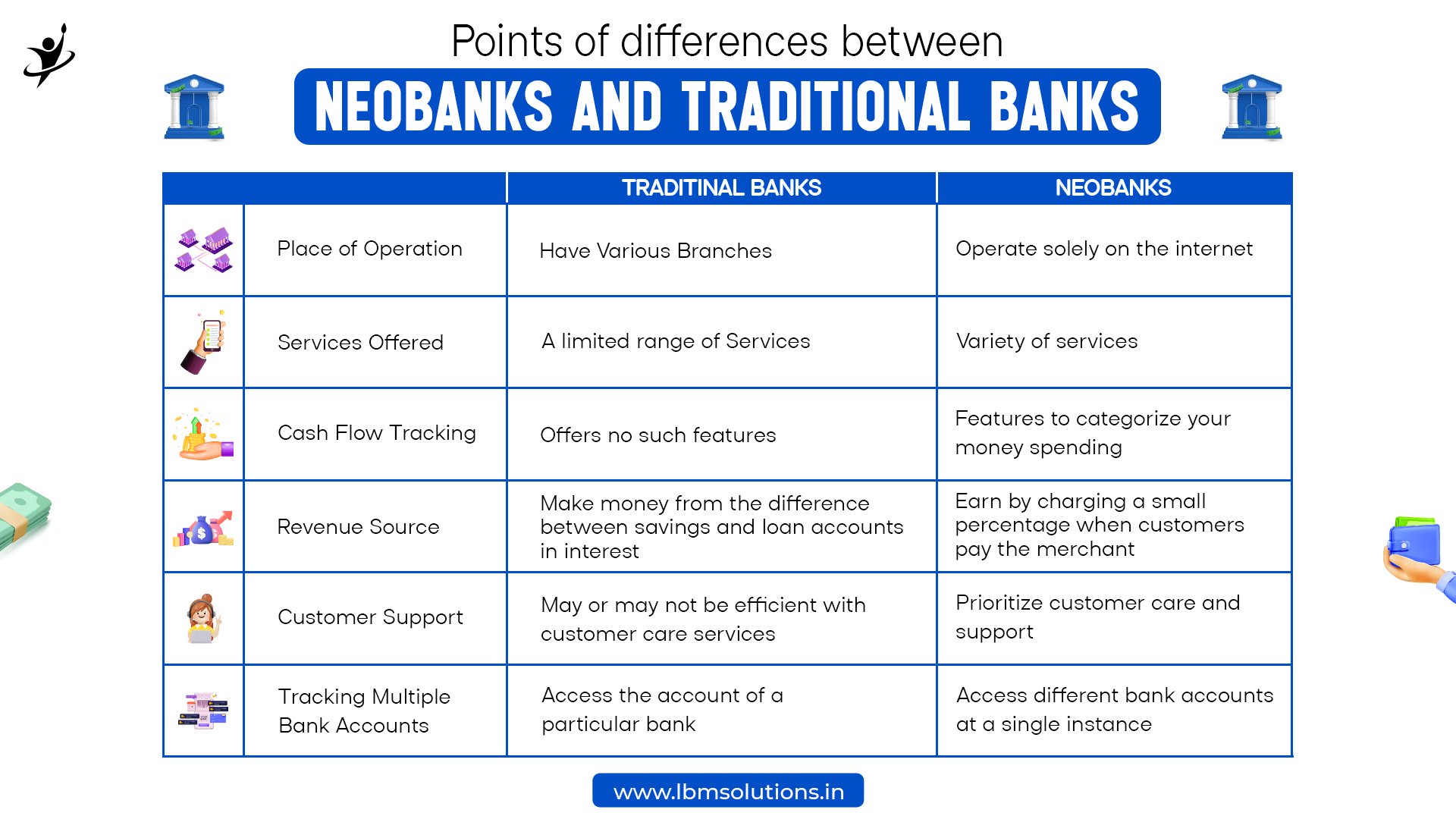

How are Neo Banks Making Money?

Neo-banks employ diverse strategies to generate revenue in contrast to traditional banks, contributing to the forecasted growth of the global neo-banking market to an estimated $333.4 billion by 2026, expanding at an impressive 47.1% annually. A cryptocurrency wallet development company derives income primarily through interest charges on deposits, account creation, and ATMs, diverging from the conventional revenue streams of established banks.

How Do Neo Banks Operate?

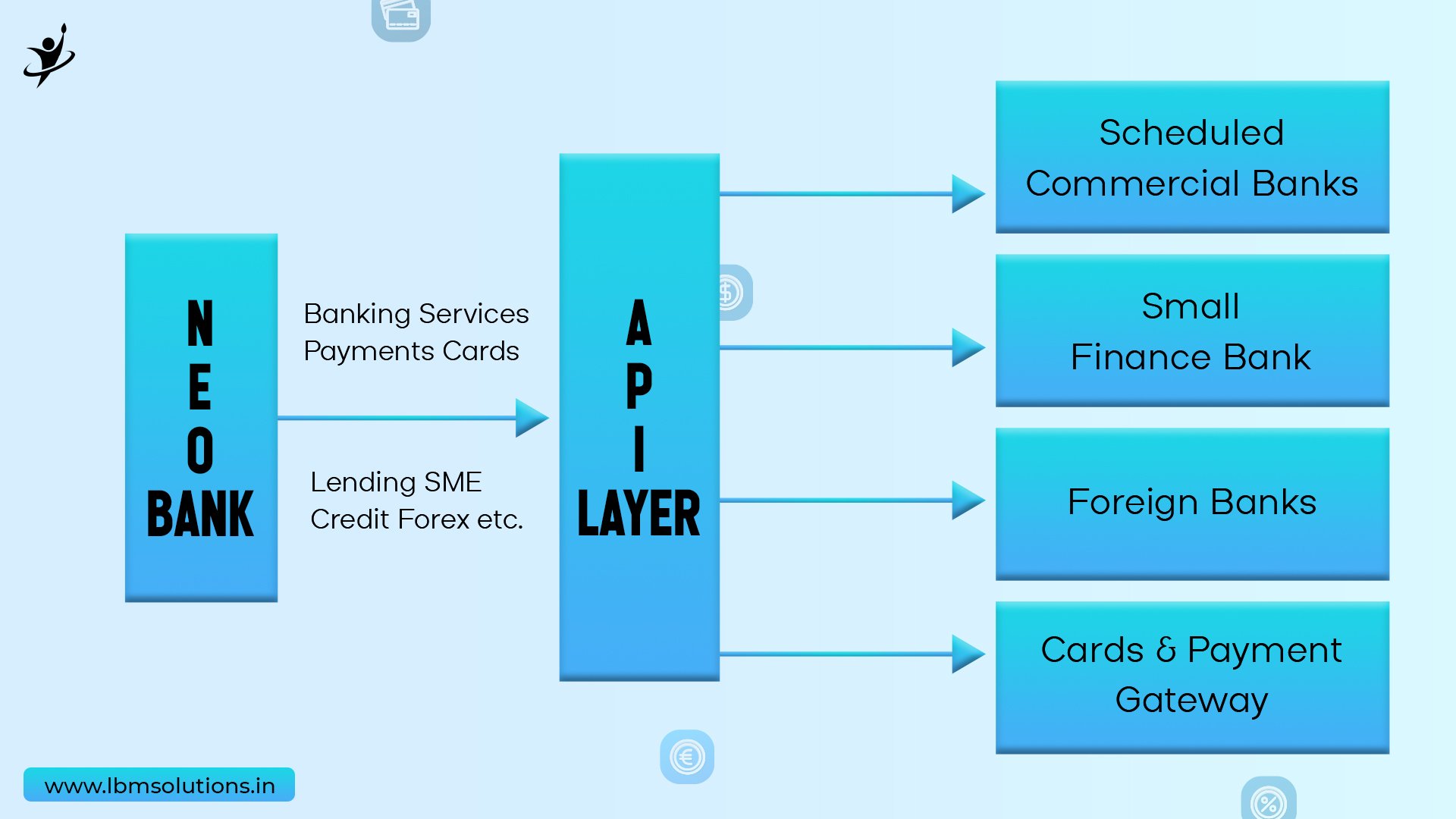

Neo-banks fundamentally operate without physical branches or traditional banking infrastructures, distinguishing them markedly from conventional banks. Like traditional banks, their primary objective revolves around facilitating credit and deposit services but with a modernized approach.

Here’s a breakdown of how neo-banks function:

- Collaboration: Neo-banks typically collaborate with established banks, leveraging user-friendly apps to provide innovative banking services.

- Operational Autonomy: They manage customer service, acquisition, and servicing, controlling the app and service distribution independently.

- Banking Partnership: These banks partner with established financial institutions to safeguard customer funds and access capital for lending.

- Data-Driven Approach: Neo-banks heavily rely on data analytics, gathering and analyzing customer data to enhance services and personalize the customer experience based on user behavior.

Neo-banking solutions encompass a range of features like electronic money transfers, online bill payments, remote direct deposits, and mobile check deposits. Furthermore, these fintech entities often offer tools for savings, budgeting, and personalized financial advice, thereby transforming the conventional role of banking into a more comprehensive money management platform. Fintech startups are leveraging the flexibility and scalability of white label neo banking platforms to swiftly enter the financial services market with tailored, customer-centric solutions.

How are Neo-banks better than traditional Banks?

Cost-Efficiency

Neobanks operate sans physical branches, sparing rent, utilities, and infrastructure expenditures, enabling them to offer customers reduced fees and higher interest rates. This surplus of resources, whether financial or human, is channeled into enhancing the overall banking experience for their clientele.

Streamlined Accessibility

Traditional bank account setups entail lengthy procedures, paperwork, and waiting times, often requiring physical visits for address verification. Neobanks revolutionized this process, providing a seamless digital account creation experience. Users can effortlessly initiate their accounts from their mobile devices within minutes, conducting tasks like check deposits remotely, aligning with modern preferences for convenient, at-home neo-banking solutions.

Enhanced User Interface (UI)

The digital revolution in banking spurred institutions to prioritize refining digital experiences. Neobank apps boast user-friendly, visually appealing interfaces, a testament to their digital-first approach. In contrast, traditional banks’ digital offerings often lag due to inherent digital constraints, unable to match the agility and sophistication of neobank applications crafted by top-tier talent.

Flexibility and Autonomy

Neobanks, devoid of full-fledged banking licenses and RBI regulations, operate with a level of autonomy distinct from traditional banks. This independence enables them to sidestep legacy policies, keeping operational costs low and fostering innovation and adaptability in their service offerings.

The Bottom-Line

Today’s consumers seek tailored, comprehensive financial management solutions for Cryptocurrency Wallet Development Company. With increased financial literacy among Millennials and Gen Z, neobanks leverage technology to create engaging tools. These platforms analyze users’ financial patterns, suggesting appropriate instruments while offering low-interest credit, high-yield savings, and cost-effective, seamless services. Neobanks emerge as a reliable choice for individuals desiring personalized financial solutions that align with their needs and preferences.